The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

Integrated Risk Management: The Keystone in Safeguarding Generative AI Against Data Poisoning

As organizations increasingly integrate AI into their operations, the role of IRM in ensuring these technologies are leveraged safely and responsibly cannot be overstated. It is through comprehensive risk management strategies that the full potential of generative AI can be realized, driving innovation while protecting against the vulnerabilities inherent in this powerful technology.

The Looming Shadow of the EU Cyber Resilience Act: How Integrated Risk Management Can Be Your Shield

The European Union's Cyber Resilience Act (CRA) looms large on the horizon, casting a shadow of both challenge and opportunity for companies selling software and connected devices in the EU. While the act's enforcement date is still months away, its comprehensive cybersecurity regulations demand proactive preparation from manufacturers, importers, and distributors alike.

Climate Disclosure Unveiled: Optimizing Risk Management in Response to SEC's Final Rules

The U.S. Securities and Exchange Commission (SEC) has enacted groundbreaking rules requiring companies to disclose their climate-related risks, marking a significant milestone in our collective journey towards sustainability and transparency in the financial world. Among these rules, the stipulation for registrants to disclose their processes for identifying, assessing, and managing material climate-related risks, and the integration of these processes into their overall risk management systems, stands out as a clarion call for a more sophisticated, integrated approach to risk management.

IRM at the Crossroads of Digital and Sustainability Risks

Risk management is undergoing a significant transformation in the rapidly evolving world of business. Integrated Risk Management (IRM) is at the forefront of this change, offering a strategic framework that navigates through both traditional and emerging risks. The "15 Trends Reshaping Business Risk Management Strategies," highlighted by The Newsweek Expert Forum, underscores the critical role of IRM in addressing a wide array of challenges, including the increasingly pivotal areas of digital and sustainability risks.

NIST CSF 2.0: Charting Your Course with IRM Technology and IRM Navigator™

This week’s release of the National Institute of Standards and Technology (NIST) Cybersecurity Framework (CSF) 2.0 presents a significant opportunity for organizations to strengthen their cybersecurity posture. This updated framework underscores the critical role of risk management in building cyber resilience, offering valuable guidance in a rapidly evolving threat landscape. However, navigating the implementation of NIST CSF 2.0 can be challenging, often hampered by siloed data, fragmented processes, and limited visibility into overall risk exposure.

Shifting Gears: Palo Alto Networks and the Future of Cybersecurity

Palo Alto Networks is taking deliberate steps to align more closely with the burgeoning Integrated Risk Management (IRM) market in a move that signals a profound shift within the cybersecurity industry. While placing Palo Alto outside of the direct IRM market play, this strategy is symbolic of a broader industry evolution. It underscores a critical pivot towards integrating cybersecurity data feeds with IRM solutions to provide a comprehensive, business-focused risk analysis.

DORA's Wide Net: More Than Just Cybersecurity for Financial Services

The recent release of draft technical standards for the European Union’s Digital Operational Resilience Act (DORA) paints a clearer picture of its sweeping reach. While many associate DORA with cybersecurity for financial institutions, it casts a wider net, encompassing third-party providers and demanding a stronger integrated risk management approach. Let's unpack the key takeaways for businesses navigating this evolving landscape, incorporating insights from various sources.

The SEC Eyes Digital and Sustainability Risks: How Can IRM Help?

Gary Gensler, Chair of the Securities and Exchange Commission (SEC), yesterday delivered a thought-provoking speech at Yale Law School, addressing the opportunities and challenges presented by digital risks (encompassing Artificial Intelligence) and sustainability risks (including climate change). While acknowledging the potential benefits of AI, he emphasized the need for robust risk management frameworks to address issues like explainability, bias, and systemic risk. This raises the crucial question: how can Integrated Risk Management (IRM) help companies navigate this evolving landscape?

Latest SEC Reports Reveal Devastating Digital Risks

In an era of unpredictability and the intertwining of global digital risks, the recent cyberattacks on Clorox and Johnson Controls serve as a stark wake-up call for businesses worldwide. Currently estimated at a combined cost of $76 million, these incidents underscore the critical need for a more sophisticated, proactive approach to risk management. The just published Accenture Risk Study: 2024 Edition echoes this sentiment, revealing a concerning trend: 72% of businesses admit their risk management capabilities are lagging behind the evolving nature of threats, particularly in cybercrime.

Exploring Integrated Risk Management Solutions with the IRM Navigator™ Reports

Understanding the landscape of Integrated Risk Management (IRM) software solutions is crucial for organizations seeking to navigate the complexities of modern risk management. Recognizing this need, Wheelhouse Advisors has developed a comprehensive suite of resources known as the IRM Navigator™ Reports. These reports are designed to provide in-depth analysis and insights into IRM software solutions across various segments and capabilities, offering a roadmap for organizations looking to elevate their risk management strategies.

Why Gartner Believes GRC Tools Fall Short in Effective Risk Management

In the evolving landscape of risk management, the need for tools that can adapt to complex and multifaceted risk environments is becoming increasingly apparent. Recent insights from Gartner highlight a significant shift in the way organizations approach risk management, with traditional Governance, Risk, and Compliance (GRC) tools struggling to meet the demands of modern enterprise risk management (ERM) strategies.

Rethinking Risk Management - Moving Beyond ESG and GRC

The once-revered concepts of environmental, social, and governance (ESG) and governance, risk, and compliance (GRC) are now subjects of intense debate and re-evaluation. As businesses grapple with the complexities of modern risk management, there's a growing recognition that the traditional ESG and GRC frameworks, while groundbreaking in their time, may no longer suffice in addressing the nuanced and multifaceted risks of the 21st century.

Integrated Risk Management in the Digital Era: Employing IRM Technology for AI Challenges

In the rapidly evolving field of artificial intelligence (AI), the recent comprehensive survey, "Thousands of AI Authors on the Future of AI," spearheaded by AI Impacts, provides critical insights into the trajectory of AI development and its societal implications. As the founder and CEO of Wheelhouse Advisors, I am particularly intrigued by the survey's findings and the essential role of Integrated Risk Management (IRM) in addressing the digital risks associated with AI.

How the EU AI Act Will Forge a New Global Digital Landscape in 2024

The European Union's Artificial Intelligence Act (AI Act), set for enactment in mid-2024, represents a landmark in the global regulatory landscape for digital products and services. This comprehensive legislation is poised to fundamentally reshape how AI is developed, deployed, and managed based on the digital risks it manifests. As the first of its kind, it establishes a precedent for digital risk management, emphasizing safety, fundamental rights, and transparency.

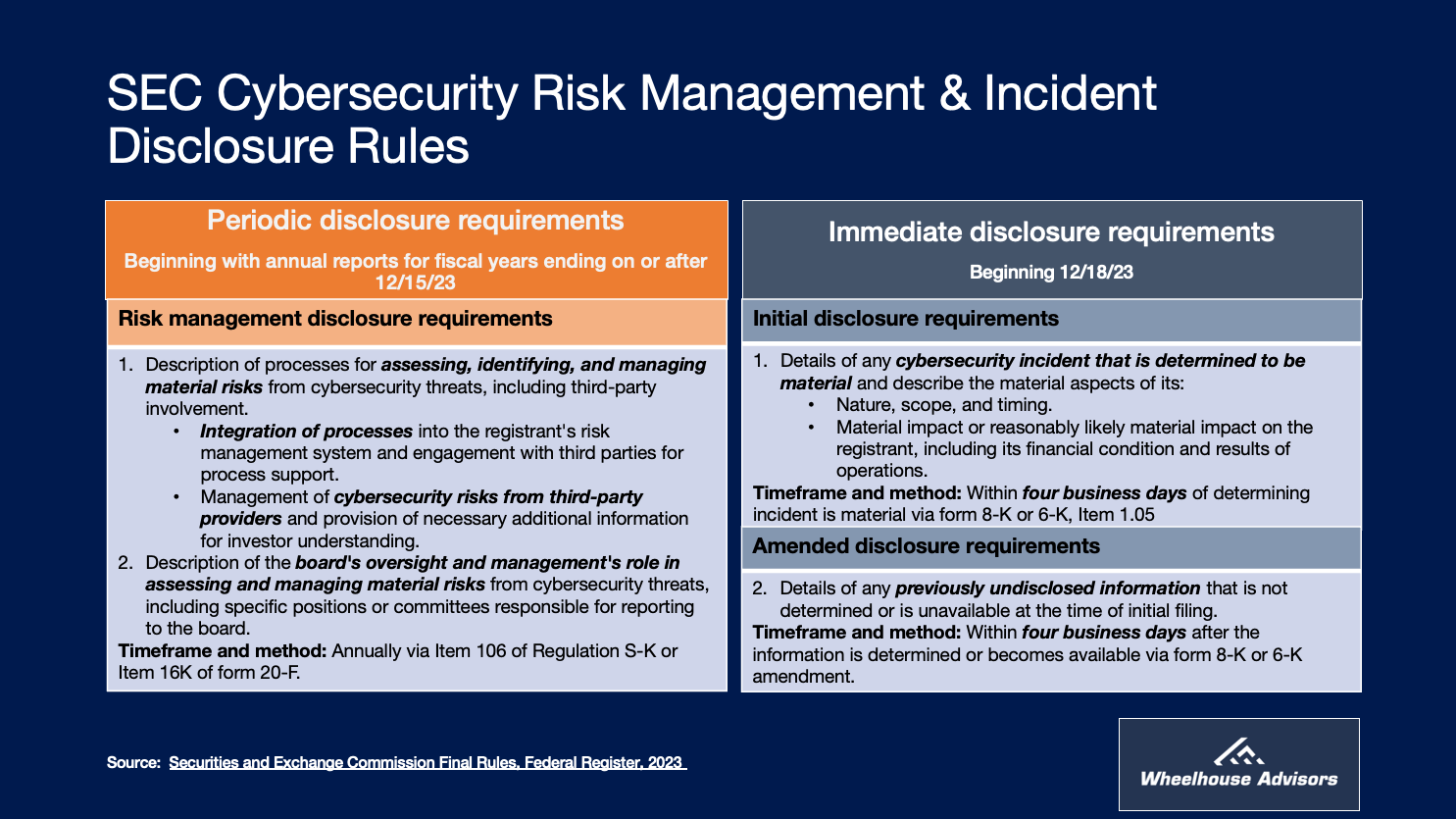

Ticking Clock: Companies Scramble to Meet SEC Cybersecurity Rules, Audit Partners Cautious

With the December 15th deadline for the SEC's new cybersecurity risk disclosure rules rapidly approaching, companies are intensifying their preparations. The Center for Audit Quality’s (CAQ) biannual Audit Partner Pulse Survey provides valuable insights into the corporate response, especially in the context of the complex economic, political, and technological challenges businesses currently face.

SEC's Cybersecurity Countdown: Critical Steps for Public Companies

As the December 2023 deadline looms, U.S. public companies and their third parties face a critical juncture in cybersecurity risk management. The SEC's new disclosure rules demand swift adaptation, with implications for cybersecurity practices and risk management infrastructures. The upcoming webinar, "Cyber Risk Reporting to the Board: A Step-by-Step Playbook," offers an in-depth analysis and actionable strategies for compliance.

Integrated Risk Management: The Linchpin for Bridging SEC and NYDFS Cybersecurity Regulations

In response to escalating cyber threats, regulatory bodies such as the New York State Department of Financial Services (NYDFS) and the U.S. Securities and Exchange Commission (SEC) have fortified their cybersecurity rules, presenting a complex regulatory environment for financial institutions. As entities strive to comply with the nuanced requirements of the NYDFS's updated cybersecurity regulations and the SEC's proposed rules, Integrated Risk Management (IRM) emerges as a crucial strategy, providing a unified framework to manage cybersecurity risks and regulatory compliance effectively.

Leveraging IRM for Comprehensive Risk Assessments in Line with SEC Guidelines

In an era where the complexity of risks continuously escalates, the integration of operational risk management (ORM), IT risk management (ITRM), enterprise risk management (ERM), and governance, risk, and compliance (GRC) technologies within the broader umbrella of Integrated Risk Management (IRM) has never been more crucial.

ERP and IRM Take Similar Paths to Shape the Modern Business Landscape

While ERP has traditionally unified core business functions — from financial management and supply chain operations to human resources — IRM is achieving a similar integration for risk management disciplines, including operational risk management (ORM), IT risk management (ITRM), enterprise risk management (ERM), and governance, risk, and compliance (GRC).

AI Risk: What Every Board Member Needs to Know

Artificial Intelligence (AI) is a double-edged sword, offering both unprecedented opportunities and complex challenges. As boards and executives grapple with the rapid advancements in AI, they must navigate a landscape fraught with both promise and peril. This article aims to equip board members with key AI insights from a recent report by the National Association of Corporate Directors (NACD) and the Data & Trust Alliance, as well as a keynote address by John A. Wheeler at AuditBoard's Audit+Beyond event.

RiskTech Journal News Updates

RiskTech Journal

Managing Risk, Embracing Technology

In today's dynamic business landscape, managing risk and embracing technology are essential components of sustainable success. The RiskTech Journal delivers timely insights for business leaders seeking better ways to manage risk using modern approaches and tools. Harnessing the power of technology enables businesses to optimize processes, enhance decision-making, and stay competitive in an increasingly digital world.

Browse the latest RTJ insight articles and news updates and below

The RiskTech Journal Online Subscription is a premier resource for executives and professionals focused on the intersection of risk management and technology. It provides subscribers with access to a curated collection of articles and expert insights designed to enhance risk management strategies through technological innovation. With its online format, the RiskTech Journal offers flexible access to critical information, helping leaders make informed decisions and stay competitive.