The RiskTech Journal

The RiskTech Journal is your premier source for insights on cutting-edge risk management technologies. We deliver expert analysis, industry trends, and practical solutions to help professionals stay ahead in an ever-changing risk landscape. Join us to explore the innovations shaping the future of risk management.

Browse the latest RTJ insight articles and news updates and below

The RiskTech Journal Online Subscription is a premier resource for executives and professionals focused on the intersection of risk management and technology. It provides subscribers with access to a curated collection of articles and expert insights designed to enhance risk management strategies through technological innovation. With its online format, the RiskTech Journal offers flexible access to critical information, helping leaders make informed decisions and stay competitive.

Discover Wheelhouse Advisors’ 2025 Integrated Risk Roadmap for Research and Insights

As the world of risk management evolves, Wheelhouse Advisors remains at the forefront of delivering insights, research, and actionable strategies to navigate the complexities of today’s dynamic risk landscape. In 2025, we will focus on four overarching themes corresponding to the key segments of the Integrated Risk Management (IRM) framework: Technology Risk Management (TRM), Operational Risk Management (ORM), Governance, Risk and Compliance (GRC), and Enterprise Risk Management (ERM). These themes will guide our content delivery through the IRM Navigator™ Reports, IRM Vendor Compass™ Ratings, The Risk Wheelhouse podcasts, and articles in The RiskTech Journal.

NIS2 and the Global Risk Landscape: Harnessing Integrated Risk Management to Stay Ahead

The EU’s NIS2 Directive represents a significant evolution in cybersecurity governance, and its ripple effects are set to transform compliance landscapes for companies worldwide. Despite uneven transposition across EU member states, NIS2's broader implications underscore the urgency for proactive risk management strategies. Companies can leverage Integrated Risk Management (IRM) solutions to turn these regulatory challenges into competitive advantages.

Navigating the DORA Deadline: Why Integrated Risk Management is Critical

The clock is ticking for financial institutions and ICT suppliers as the EU’s Digital Operational Resilience Act (DORA) prepares to take effect on January 17, 2025. This ambitious regulatory framework aims to bolster the financial sector's resilience against cyber disruptions, mandating a series of stringent requirements on operational monitoring, incident reporting, and third-party risk management. Yet, the urgency of compliance efforts has uncovered a glaring challenge: organizations without Integrated Risk Management (IRM) systems risk falling short of these critical obligations.

The Future of AI Agents in Integrated Risk Management

The digital transformation of risk management has entered a new era with the emergence of AI agents, autonomous systems that promise to revolutionize how organizations approach integrated risk management (IRM). These sophisticated systems represent more than just an automation tool; they offer a fundamental shift in how organizations identify, assess, and respond to risks across their operations. As organizations face increasingly complex risk landscapes, AI agents provide the capability to handle this complexity while maintaining the comprehensive perspective essential to effective IRM.

How S&P 100 Leaders Drive Cybersecurity Excellence Through Integrated Risk Management

Recent insights from the Gibson Dunn report, Cybersecurity Overview: A Survey of Form 10-K Cybersecurity Disclosures by the S&P 100 Companies, highlight key trends and practices among public companies. Integrated Risk Management (IRM) is increasingly recognized as the critical approach enabling organizations to meet these requirements while driving strategic value. In this analysis, we'll explore the evolving regulatory landscape, key trends in cybersecurity disclosures, and how IRM empowers organizations to align their cybersecurity strategies with enterprise-wide governance frameworks.

Restating Trust: Tackling the Rise in Financial Restatements with Integrated Risk Management

The financial landscape has been disrupted by a concerning surge in financial restatements among U.S. public companies. According to the Financial Times, 140 public companies reissued their financial statements in the first ten months of 2024 due to material accounting errors—a nine-year high. These restatements erode investor confidence and raise critical questions about the quality of financial reporting, the robustness of internal controls, and the effectiveness of corporate governance. Notable cases, such as Macy's misclassification of $132 million in delivery expenses and Archer Daniels Midland's overstated profits in its nutrition segment, underscore these errors' severe reputational and financial implications. This trend highlights systemic weaknesses that can no longer be overlooked. The rise in restatements calls for a comprehensive solution—one that Integrated Risk Management (IRM) technology and related RiskTech innovations are well-equipped to deliver.

Transitioning from Fragmented GRC to Integrated Risk Management: A Path Forward

The IRM approach replaces the traditional, siloed GRC model with a unified framework. By transitioning to IRM, organizations can enhance strategic decision-making, increase operational efficiency, and gain a complete view of risks across the enterprise. This transition is not just about adopting a new framework; it's about unlocking the value of risk management as a strategic asset.

Navigating IFRS S1 and IFRS S2: A Pathway for Integrated Risk Management and Sustainability

As sustainability reporting becomes increasingly critical for businesses, preparers are faced with new challenges and opportunities. The voluntary application of the International Sustainability Standards Board (ISSB) Standards, specifically IFRS S1 and IFRS S2, offers a framework for companies to disclose sustainability-related financial information, even ahead of regulatory mandates. To support companies, the IFRS Foundation has published Voluntarily applying ISSB Standards—A guide for preparers. This guide published provides companies a pathway to communicate their progress in aligning with these standards, supporting investor decision-making by offering transparent, comparable, and reliable information on sustainability risks and opportunities.

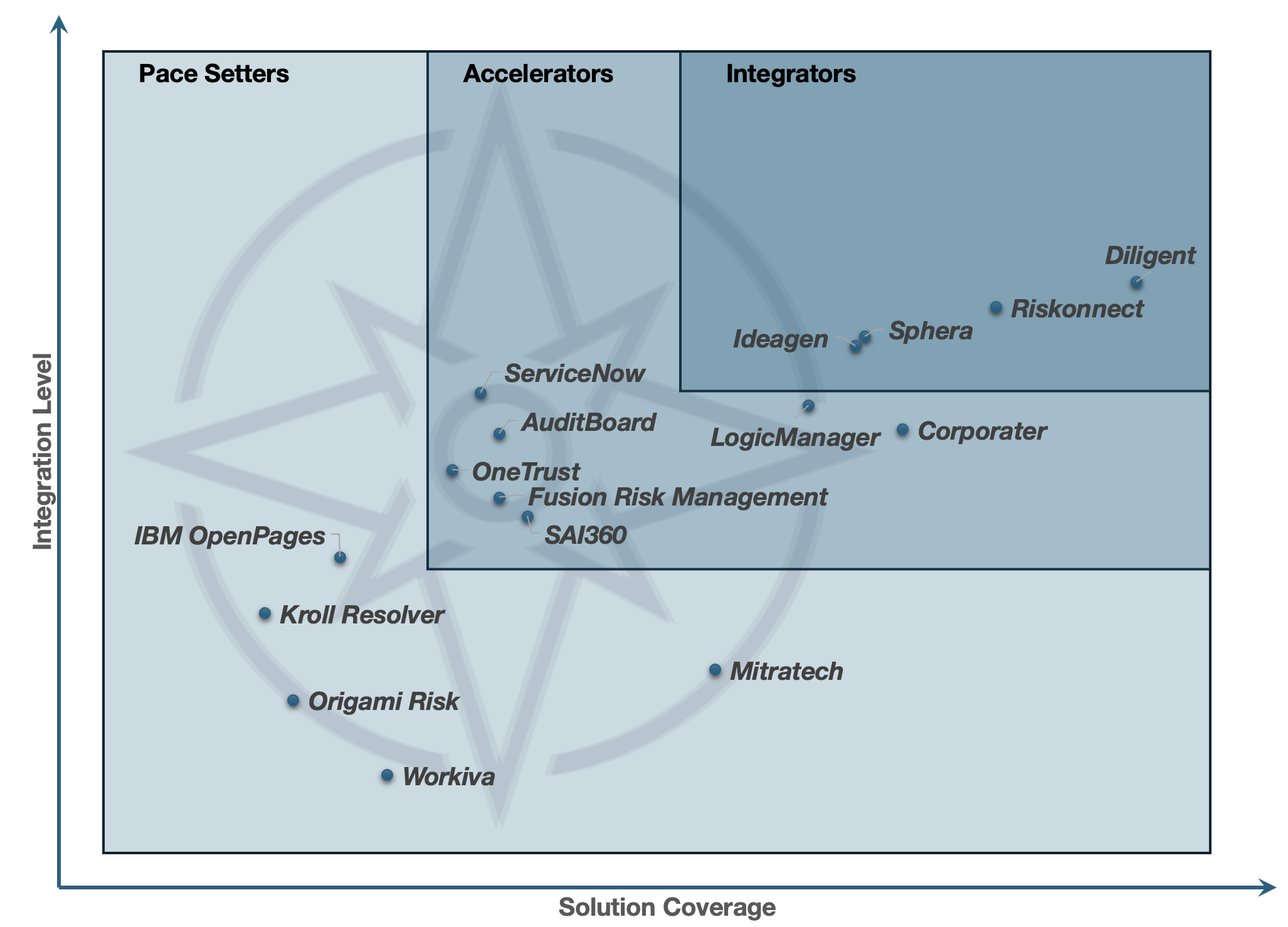

Unlocking the IRM Market: A Deep Dive into the 2024 IRM Navigator™ Buyer Persona Guide

In the rapidly evolving technology market landscape of Integrated Risk Management (IRM), understanding the intricacies of buyer personas is paramount for technology providers aiming to make a significant impact. The recently published 2024 IRM Navigator™ Buyer Persona Guide for Integrated Risk Management (IRM) by Wheelhouse Advisors emerges as a crucial resource for Chief Marketing Officers (CMOs), Chief Product Officers (CPOs), and business leaders. This comprehensive guide dissects the complex IRM market and offers actionable insights to tailor strategies effectively.